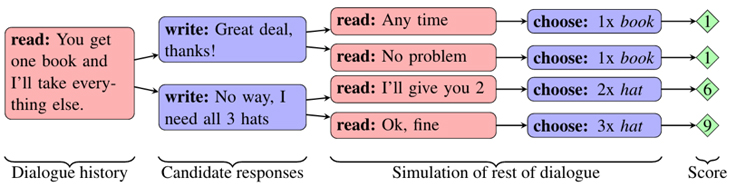

Facebook is training artificial intelligence to be able to negotiate. According to a team of researchers from Facebook Artificial Intelligence Research (FAIR), they have developed a way for dialog agents to engage in negotiations from start to finish. Tasks include multi-issue bargaining, dialog rollouts, and building and evaluating a negotiation data set

“To date, existing work on chatbots has led to systems that can hold short conversations and perform simple tasks such as booking a restaurant. But building machines that can hold meaningful conversations with people is challenging because it requires a bot to combine its understanding of the conversation with its knowledge of the world, and then produce a new sentence that helps it achieve its goals,” the team wrote in a post.

The researchers have released the new capability into open source.

Slack introduces new feature

Slack is announcing a new feature to help users communicate and work more efficiently. The company announced Highlights, a new solution designed to give users the ability to focus on their most important items, and catch up on anything they miss.

“At the top of All Unreads, Slack will surface a selection of the most important messages, powered by how you uniquely work in Slack. Slack will also highlight important unread messages within channels, so you can skim and get up to speed in the channels you haven’t checked in awhile,” Jerry Talton from engineering manager at Slack, wrote in a post.

IBM launches cognitive solutions for RegTech

In order to help financial institution professionals manage regulatory and fiduciary responsibilities, IBM launched a suite of cognitive solutions powered by Watson to tackle three areas of the industry.

The Watson powered software is designed to help financial professionals with understanding regulatory requirements, it will help deliver increased insight into financial crimes, and it will help manage financial risk with new architectural approaches for data, according to IBM.

“Two generations ago, IBM brought the first computers to the financial services sector, allowing banks and other institutions to foster greater trust in the market by operating more efficiently and accurately,” said Bridget van Kralingen, senior vice president, IBM Industry Platforms. “To strengthen trust today, financial institutions must analyze an industry’s worth of information to help monitor risk and compliance. No individual, or team of them, can adequately do this alone, and so once again, IBM is bringing a new type of computing – cognitive computing – to help these professionals operate more effectively.”

More information is available here.