Which mobile operating system will developers place their bets on in 2011? For most it will depend on a particular platform’s reach, while for others, it’s about what’s “sexy” at the time, experts said.

In an October “State of the Apps Industry Snapshot” survey conducted by mobile advertising firm Millennial Media, “reach” (or the number of consumers in a platform’s audience) was the most important consideration for developers and publishers choosing a platform, while ease of use took fourth place.

Twenty-nine percent of the 336 publisher and developer respondents also indicated they will be creating apps for the Android operating system this year. Windows Phone 7 and the iPad tied for second place, grabbing 20% of the respondents’ interest. RIM took fourth with 12%, while the iPhone trailed in fifth with 8% of developer and publisher interest. However, according to the survey, the iPhone reigned supreme in 2010 with 30% of the respondents developing for it. Twenty-three percent indicated developing for Android last year.

“If you asked me a year ago about Android, I would say it’s looking up,” said Ramon Llamas, senior research analyst for mobile devices and technology trends at IDC. “Now, it’s a question of ‘How big is it going to be?’

“Last year [Android] was kind of a dark horse. We only had a chance to see what Motorola was doing, and now we have a chance to see what HTC and Samsung is doing, and it’s really going to take off.”

The platform’s openness is a great thing for developers, but the downside is its fragmentation, especially for game developers, Llamas added.

Andy Rubin, vice president of engineering at Google and the chief architect behind Android, addressed the platform’s fragmentation at December’s D: Dive Into Mobile conference in San Francisco. Calling it “differentiation” instead (because manufacturers and carriers can tailor Android devices to more or less their liking), Rubin acknowledged that Android is somewhat clunky right now.

“I would characterize Android today as an early adopter for tech enthusiasts…In the future, I think you’ll see a little more attention to detail,” Rubin said, as he hinted toward a smoother user experience coming down the pike.

As for this year’s dark horse, it’s Windows Phone 7 for Llamas. At launch, Microsoft started with 2,000 applications in its app store Marketplace, while its target was 1,000, he said. Almost a month later, Marketplace had 3,000 applications available, and “that’s pretty darn significant,” Llamas added.

“Microsoft is making overtures to get more developers on board,” he said. “It’s been working. We just need to see more velocity. It hasn’t reached the ‘sexiness’ that you see from Android or the iPhone, but it’s still very, very early to tell.”

“There’s no question [Microsoft] came to the game late,” said Todd Anglin, an evangelist for Telerik. But “where Microsoft historically excels is serving the developer community. BlackBerry, Android, iPhone…none have a reputation of being developer friendly.”

However, Llamas pointed out BlackBerry’s efforts to draw in developers in terms of how much money is given back to them. But “it’s been over two years now [since App World launched], and they’re making some of the smaller volume of apps available. They lack momentum in terms of pushing BlackBerry apps,” he said.

BlackBerry is more about e-mail and messaging, not applications, which are typically specified for individual enterprises, he added.

And despite recent reports and numbers showing some slip in the iPhone’s market share, it is the standard-setter, Llamas said. The iPhone is “sexy” and the app market broke open because of it. Also, “there is a base out there, and it’s not about a desire to have the device. It’s outright lust,” he added.

Aside from a faithful fan base, reach also depends on the manufacturer and carriers of a given device, which really “plays an instrumental role in a platform’s success in the U.S.,” said Ross Rubin, director of industry analysis at market research firm The NPD Group.

“Apple’s market share is holding relatively steady, limited by its exclusivity to AT&T. Android is growing strongly [citing its 44% U.S. market share in Q3 2010] and some of that is on the back of Verizon’s support,” he said. Additionally, a lot of manufacturers are committing to Android, such as Motorola, Samsung and Sony, he pointed out.

But to Telerik’s Anglin, Google has done very little to popularize its platform and has relied on its manufacturers to do its marketing. “Google wants to be an advertising company in front of everyone’s eyeballs,” he said.

However Android gains its popularity, it comes at the expense of BlackBerry, particularly at Sprint and Verizon, Ross Rubin said. And despite BlackBerry doing traditionally well in the consumer market and showing continued strength with enterprises, more companies are starting to attack this space. Organizations are starting to allow the use of Android handsets and iPhones in addition to BlackBerry devices, he added.

Windows Phone 7 is also gaining momentum, said Al Hilwa, director of applications development software at IDC. BlackBerry is the larger mobile enterprise platform, he said, but whether Microsoft can make inroads into RIM’s territory is a cliffhanger.

“[Microsoft and RIM] are the best positioned from an enterprise perspective. I think Microsoft is particularly well positioned to leverage its enterprise software presence for mobile device adoption,” he said.

Ross Rubin agreed, adding, “While the pendulum has swung more to the consumer side in Window Phone 7’s initial release, they clearly have good exchange and support, and over time both [BlackBerry and Windows Phone 7] will be starring in the enterprise.”

But the extent to which Windows Phone 7 will gain market share will most likely depend on the carriers, Ross Rubin said. “It will be hard to make much headway at AT&T since Apple is a much more mature device with very strong branding, but this is the challenge out of the gate for Apple competitors.”

Additionally, “there are rumors that the iPhone may move to Verizon in 2011. If that happens, it’s hard to say what will happen. [The iPhone] would most likely grab a significant share at the expense of Android at Verizon,” Ross Rubin said.

Developer interest in a particular platform should also reflect where vendors are showing their vested interests, said IDC’s Llamas. For example, Nokia’s Symbian operating system has a huge install base and is widely accepted in Europe and emerging markets, but Nokia is showing movement toward Meego, a Linux-based, open-source mobile operating system, he said.

“Do you want to go with the biggest install base now or where Nokia is placing its bets in the future?” Llamas asked.

Apple’s cofounder Steve Wozniak already placed his bets on the mobile race. In a November interview with a Dutch-language newspaper, Wozniak divulged that Android will most likely become the dominant mobile operating system, ahead of iOS and Symbian. He also said Nokia was “the brand of the previous generation.”

Analyst firm Gartner also anticipates Android’s exponential growth past Symbian. In a September survey, Gartner said, Android will become the No. 1 operating system worldwide by 2014, passing Symbian’s years-long hold on that distinction.

The competitors

Android OS:

Supported Web technology: Flash and HTML5

Projected U.S. market share in 2011: 36%, according to research firm IDC

Projected worldwide market share in 2011: 21%

Number of applications in Market: More than 100,000

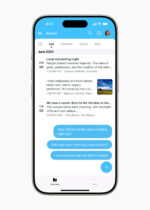

2011 road map: Designed specifically for tablet devices, Android 3.0, also known as Honeycomb, is due out sometime this year. Andy Rubin, vice president of engineering at Google and chief architect behind Android, showed a Motorola prototype running the operating system at D: Dive Into Mobile. Some new features included a sleek e-mail interface and new 3D features on Google Maps.

BlackBerry OS:

Supported Web technology: Flash and HTML5

Projected U.S. market share in 2011: 28%

Projected worldwide market share in 2011: 17%

Number of applications in BlackBerry App World: 15,000

2011 road map: Research in Motion co-CEO Mike Lazaridis said at the D: Dive Into Mobile conference that RIM is launching its 7-inch PlayBook tablet computer in the first quarter of 2011. He also said the Tablet OS, which supports Flash, will eventually make its way to future smartphones with more complex, multicore processors. Lazaridis did not specify when it will come out, however.

iOS:

Supported Web technology: HTML5

Projected U.S. market share in 2011 (for iPhone): 17%

Projected worldwide market share in 2011 (for iPhone): 13%

Number of applications in the App Store: More than 300,000

2011 road map: Apple could not be reached for comment.

Windows Phone 7 OS:

Supported Web technology: Silverlight, and “Adobe and Microsoft have also announced their intent to bring Flash to Windows Phone 7,” said Ross Rubin, director of industry analysis at market research firm The NPD Group. Also, “In theory, [Silverlight] should be able to be implemented by the same [operating systems] that support Flash,” he added.

Projected U.S. market share in 2011 (for 6.x and Phone 7): 14%

Projected worldwide market share in 2011 (for 6.x and Phone 7: 9%

Number of applications in Marketplace: Nearly 4,000

2011 road map: Developer payouts for application and game sales will be made available the fourth week of January. “This payout will include payment for all sales of Windows Phone 7 apps and games that occurred after the phones became available in October 2010 through the end of December 2010,” blogged Todd Brix, senior director for mobile platform services product management at Microsoft. No additional information on 2011 plans was given.