Most people associate venture capital with startups. Yet two venerable technology companies—CollabNet and Uniface—have benefited from funding to embark on the next chapters of their corporate stories.

Uniface was founded in 1984 and grew to become the leading 4GL tool provider in the industry. In 1994, the company was acquired by Compuware, and Uniface was the flagship part of Compuware’s offering for a time. But as Compuware has decided application performance management was its core strength, it spun off Uniface and two other business units—Changepoint and Professional Services—to Marlin Equity Partners for US$160 million.

I spoke with Aad van Schetsen, president of Uniface, about the company’s release from Compuware. “For the last five years, we’ve been running in Compuware almost completely independently,” he said from the company’s headquarters in Amsterdam. “Our objective now is to achieve growth by increasing R&D and expanding products, and perhaps acquisitions to expand the Uniface platform.”

Uniface is a platform van Schetsen said is used primarily by big organizations with big applications, “in markets where nothing can go wrong.” He cited the airline KLM and the shipping company DHL, as well as Ford Motor Company as among Uniface’s 1,600 customers.

The Uniface development environment is fully model-driven, van Schetsen explained, and it has its own development language for component-based application development. He described the platform as “very open and versatile. You can deploy in many paradigms without changing the application.” Web developers can easily build components in the Uniface language, he added, or they can use JavaScript. “It’s not uncommon for a Uniface application to have 10,000 components.”

Meanwhile, Vector Capital of Brisbane, Calif., acquired a controlling interest of CollabNet and made an equity investment for it to bolster its position in the cloud ALM market. The value of the buyout of existing investors and shareholders and the subsequent equity investment were not disclosed.

“A consistent theme we’re seeing is that agile has won at the workgroup but has disrupted enterprise collaboration and integration,” CollabNet’s CEO Bill Portelli told me after the deal closed. CollabNet, of course, is the company that pioneered collaboration and development tooling for distributed development teams. “We were cloud-only before we even knew what it was called,” he said.

(Related: News out of CollabNet)

CollabNet sought the investment, Portelli said, because “the opportunity was bigger than the rate we were growing at, and the market is larger than we had the ability to serve.”

He said the company will invest in product delivery for the TeamForge ALM platform, look to partner to deliver products and services for “the Internet of things,” and to find acquisitions that will drive growth in the areas of open-source, agile training and consulting.

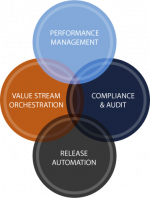

Portelli sees the federation of ALM as an area of opportunity. “We want to give traceability from requirements to delivery in any tool,” he said. The company’s Orchestrate tool, now within TeamForge, pulls data from all the tools in the life cycle, grabbing metadata and synthesizing it for visualizations that can help with the discovery and remediation of issues.

“Collaboration has never been more important,” Portelli said. “You need not just agile planning, but an infrastructure to automate that.”